The crypto market is full of opportunities, but also full of traps. Before you invest your hard-earned money, you need to know how to verify if a token is legitimate. Is token a scam? This question should be the first thing on your mind when you discover a new cryptocurrency project. In this guide, I'll show you how to use tools like DEXTools Scanner to protect yourself from fraud.

Note: This post is not sponsored - we're simply sharing the tools we've found most useful for verifying token legitimacy.

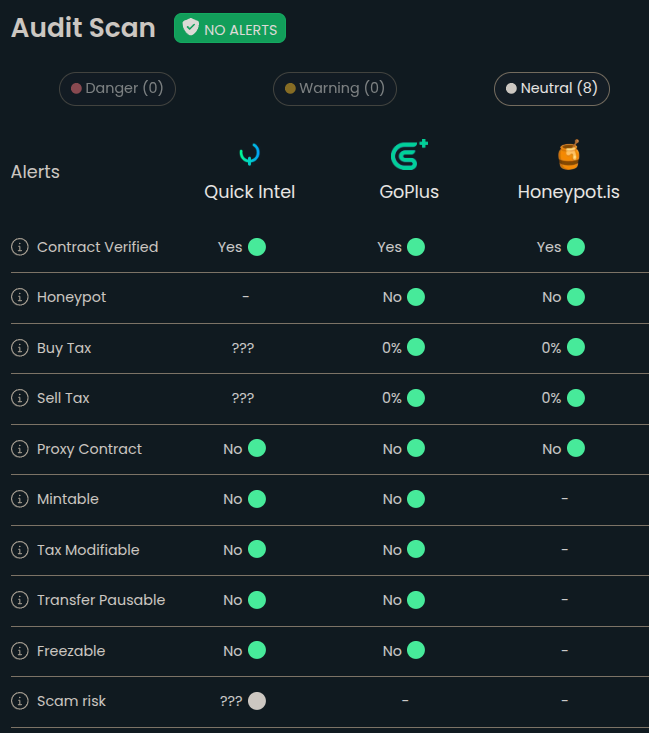

Understanding the DEXTools Audit Scanner

DEXTools offers a powerful audit scanner that analyzes tokens across multiple security dimensions. The tool compares results from three different audit engines i.e. Quick Intel, GoPlus Token Security, and Honeypot.is. Each provides a slightly different perspective on token security, giving you a comprehensive view of potential risks.

Let's break down each audit category to help you determine whether a token is a scam or a legitimate investment.

Key Security Checks Explained

- Contract Verified means the token's source code has been published and confirmed on the blockchain explorer. Unverified contracts are a major red flag. Is token a scam if developers won't show their code? Most likely yes.

- Honeypot Detection is one of the most insidious scams in crypto. These tokens allow you to buy but prevent you from selling, locking your funds in the contract. "No" - meaning the token can be sold. A "Yes" would be an immediate deal-breaker.

- Buy Tax and Sell Tax - transaction taxes are fees charged when buying or selling tokens. While some legitimate projects use modest taxes (typically 0-5%) to fund development or marketing, excessive taxes are predatory. Is token a scam if it has high tax rates? Not necessarily, but it warrants additional investigation.

- Proxy Contract allows developers to modify the token's code after deployment. While they have legitimate uses in upgradeable systems, they also introduce risk.

- Mintable Tokens - if a token is mintable, the owner can create new tokens at will, potentially diluting your investment's value. A mintable token isn't automatically a scam, but it requires strong justification and transparent tokenomics.

- Tax Modifiable - this indicates whether the contract owner can change tax rates after launch. "No" across the board is excellent news - it means developers can't suddenly impose a 99% sell tax to trap holders. Is token a scam if taxes can be modified? It's definitely a red flag worth investigating.

- Transfer Pausable - Can the owner freeze all token transfers? A pausable token gives developers significant control over token movement, which could be misused to prevent selling during problematic situations.

- Freezable (blacklist) - This feature allows developers to lock individual wallets, potentially preventing specific users from trading. This feature is rarely justified and should raise serious concerns.

- Scam Risk Assessment - shows the likelihood of any scam risk associated with the token.

What Does a Healthy Token Look Like?

A legitimate token typically shows: verified contract source code, no honeypot detection, reasonable tax rates (0-5% or none), non-mintable supply, immutable tax settings, no transfer pause functionality, and minimal or no blacklist capabilities. When you see most or all of these characteristics together, you're looking at a project that prioritizes holder security and transparency.

Additional Security Factors to Consider

Liquidity Lock and Burn

Liquidity is the pool of tokens that enables trading on decentralized exchanges. Understanding whether a token is legitimate often depends on what developers do with this liquidity.

Liquidity Lock - legitimate projects lock their liquidity for extended periods (6 months to several years). This prevents developers from draining the trading pool - a common rug pull technique.

An even stronger signal is burning liquidity tokens, making it impossible for anyone to remove liquidity forever. Some DEXes like Raydium and Quickswap offer native liquidity burn mechanisms while still allowing liquidity providers to accrue trading fees with burned liquidity. This is the gold standard of commitment.

Is token a scam if liquidity isn't locked? While not definitive proof, it's certainly a major red flag that should make you think twice.

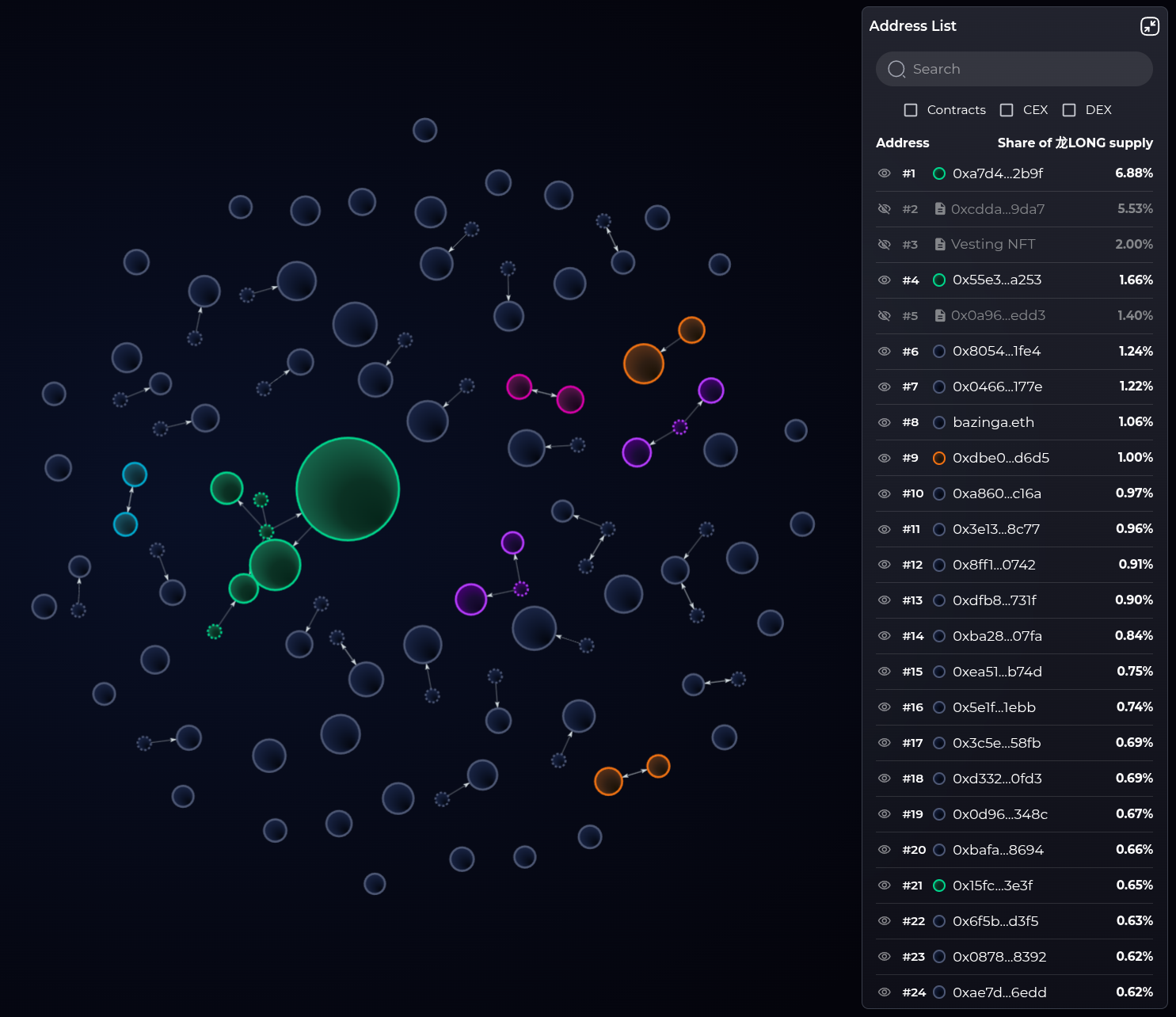

Token Holdings Distribution

Check who holds the token and how much. If the top 10 wallets control 80% of the supply, you're highly exposed to their trading decisions. Less concentrated holdings mean less risk of coordinated dumps. Block explorers like Etherscan or BSCScan can greatly help here by showing live holder distribution.

Is token a scam if the team holds a massive portion of supply? This creates concerning vulnerability to large sell-offs. Look for projects where:

- Top 10 wallets hold less than 30% combined

- Developer wallets are clearly identified and locked

- Distribution is gradual and transparent

For example, many successful long-term projects maintain top 10 wallet holdings between 15-25% combined, with team allocations clearly locked or vested over 1-2 years. This balanced distribution ensures no single entity can manipulate the market while still allowing founders to maintain reasonable stakes in their project.

One of the most powerful tools for detecting suspicious wallet relationships is Bubblemaps.io. These visual maps show connections between wallet addresses (clusters), revealing hidden relationships that might not be obvious from simple holder lists.

Bubble maps display wallets as bubbles, with size representing the amount held and connecting lines showing token transfers between addresses. This visualization can expose:

- Clustered Ownership - When multiple wallets appear connected to a central address, it often means one entity controls numerous wallets to disguise their true holdings. This is a classic technique to make distribution look healthier than it actually is.

- Bundler - Scammers create dozens of wallets, all funded from the same source, to simulate organic community adoption. Bubble maps quickly reveals these artificial networks through their interconnected patterns.

- Wash Trading Detection - Repeated transfers between connected wallets can indicate fake volume creation. When examining the bubble map pay attention to unnatural circular patterns of token movement.

A healthy bubble maps visualization shows distributed bubbles with minimal clustering. If you see a spider web pattern with most tokens traceable back to a few central nodes, that's a warning sign worth investigating further.

Owner Renounced / Authorities Revoked

Renouncing ownership of token smart contract means developers have permanently given up control of the token. They can't pause transfers, modify taxes, or make any changes. This is generally very positive for decentralization and security.

However, renouncing also means legitimate updates are impossible. The best projects either:

- Renounce ownership after establishing trust

- Use timelocks for ownership (changes require waiting periods)

- Implement multi-signature wallets requiring multiple approvals

Easiest way to check if ownership is renounced is by looking at the token contract on a blockchain explorer. Then in "Read contract" tab, searching for the "owner" function and checking if it’s set to 0x0 address.

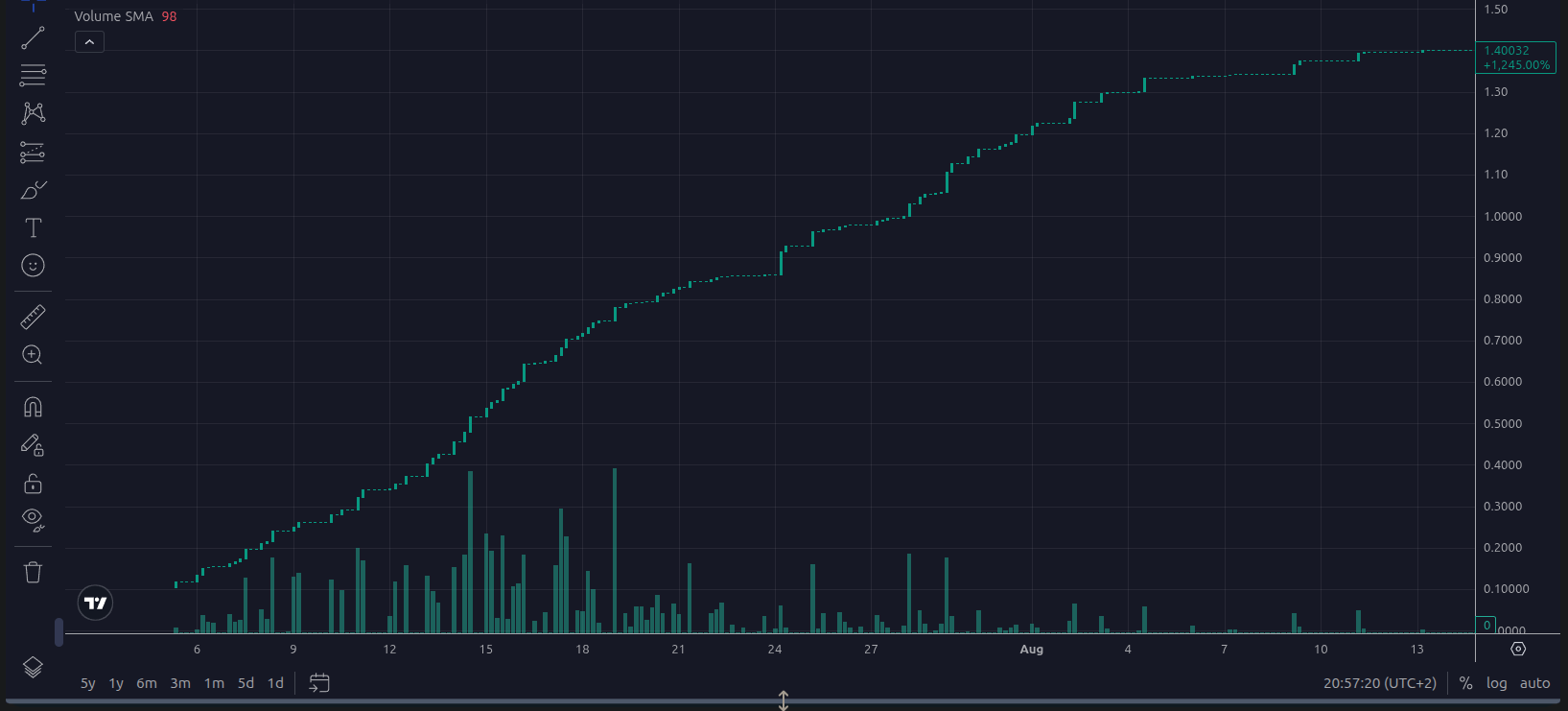

Suspicious Chart Patterns

Even if a token passes scanner checks, the price chart can reveal manipulation. When examining charts, watch for these patterns:

Straight Line Growth / No Corrections

Healthy markets move in waves - up, down, consolidation, repeat. A perfectly straight upward line with zero pullbacks strongly suggests manipulation. This pattern often indicates:

- Artificial price pumping and Bot-controlled trading

- Honeypot mechanism (no one can sell to create downward pressure)

Real organic growth includes profit-taking, dips, and volatility. If the chart looks too perfect, it probably is.

Single Sharp Dump in Price History

A massive single-candle dump of 70-99% that never recovers is the signature of a rug pull. The developers sold their holdings all at once, crashed the price, and likely abandoned the project. Sometimes they'll launch a new scam token and repeat the process.

Is token a scam if it shows this pattern? Absolutely - this is clear evidence of a rug pull. Look at the entire price history, not just recent action.

Final Thoughts

The question "Is token a scam?" doesn't always have a simple yes or no answer. Crypto exists on a spectrum from completely legitimate to higher-risk projects. Your job as an investor is to assess these factors and make informed decisions based on your research and risk tolerance.

Tools like DEXTools Scanner, Bubblemaps, and blockchain explorers are invaluable resources that can help you make smarter investment choices. Combine automated checks with manual research, community investigation, and healthy skepticism.

If you're creating your own token, consider using platforms like 20lab that come with built-in anti-scam features. These include options to create non-mintable tokens, set immutable tax rates after renouncing ownership, and implement other security measures that help build trust with your community from day one. Starting with the right foundation makes it easier to build a legitimate, sustainable project.