Impact of Raydium on Your Token's Success

Creating a successful token on Solana requires establishing robust liquidity to ensure sustainable trading and long-term viability. Raydium, a cornerstone of the Solana DeFi ecosystem, offers a powerful infrastructure that has revolutionized token launches and trading dynamics.

As one of Solana's leading decentralized exchanges (DEX), Raydium uniquely combines automated market maker (AMM) functionality with a traditional order book system. This hybrid model provides token creators with powerful tools for establishing and maintaining market presence. The following guide will walk you through the essential steps of adding initial liquidity on Raydium, with a focus on security and best practices.

Understanding Raydium's Pool Types

Currently Raydium offers three distinct pool creation options, each serving different needs in the ecosystem:

Standard AMM (CP-Swap)

- Latest Technology: Implements Constant Product Market Maker algorithm

- Cost-Efficient: Lower creation costs due to simplified structure

- Token Support: Full compatibility with Token-2022 standard

- Setup Process: Streamlined pool creation without OpenBook market ID requirement

Legacy AMM v4

- Traditional Model: Integrates with OpenBook for enhanced liquidity

- Creation Cost: Higher initial SOL requirement (approximately 0.7 SOL)

- Market Structure: Includes automated OpenBook market creation

- Compatibility: Better suited for standard SPL tokens

Concentrated liquidity (CLMM)

- Advanced Features: Offers concentrated liquidity positions for higher capital efficiency

- Fee Flexibility: Multiple fee tiers (e.g. 0.01%, 0.05%, 0.25%, 1%)

- Complex Management: Requires active position management (similar to Uniswap V3 pool or any concentrated pool)

- Liquidity Efficiency: Allows LPs to concentrate liquidity in specific price ranges

- Target Use: Best suited for pairs with established trading patterns and active management

Why Choose Standard AMM for Token Launch?

The new Standard AMM pool type has become the preferred choice for most token launches on Raydium and offers significant advantages for projects entering the Solana ecosystem. Its streamlined approach to liquidity provision eliminates the need to create an OpenBook Market ID, resulting in lower setup costs and faster deployment times. This makes it particularly attractive to new projects looking to establish a market presence quickly and cost-effectively.

One of the most significant advantages of Standard AMM is its full compatibility with Solana's Token-2022 program. This advanced token standard opens new possibilities for token creators and supports new feature extensions. This compatibility ensures that projects can utilize advanced token features while maintaining seamless integration with Raydium's liquidity infrastructure.

For tokens created using 20lab's token generator, standard AMM compatibility is guaranteed as we ensure that your token contains only supported extensions - Transfer Fees, Metadata or Metadata Pointer. This means you can confidently create your pool using the Standard AMM option without any compatibility concerns.

However, it's important to note that if your token has freeze authority enabled, you should consider disabling it before creating your pool. Raydium will display a freeze authority warning to potential traders, which could impact your token's credibility and trading acceptance. By addressing these technical requirements upfront, you'll ensure a smooth and professional launch on Raydium's platform.

Step-by-Step Liquidity Addition Guide

Before you begin the pool creation process, you should gather these essential items:

- Your token address (token mint address)

- Amount of tokens needed for initial liquidity

- SOL for transaction fees and pool creation fees

- Collateral in SOL or other tokens to place alongside your token in the liquidity pool

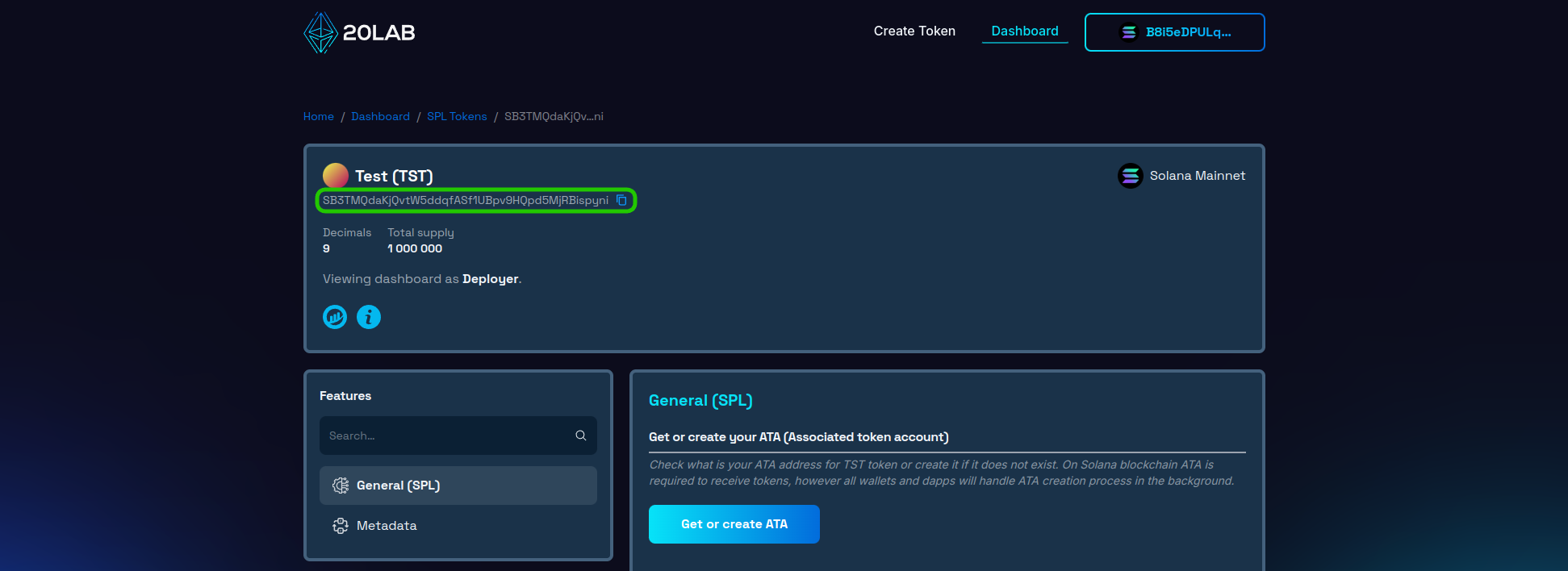

If you created your token on 20lab, you can easily copy the token mint address from the dashboard.

Once you have all of the above ready, let's follow these steps:

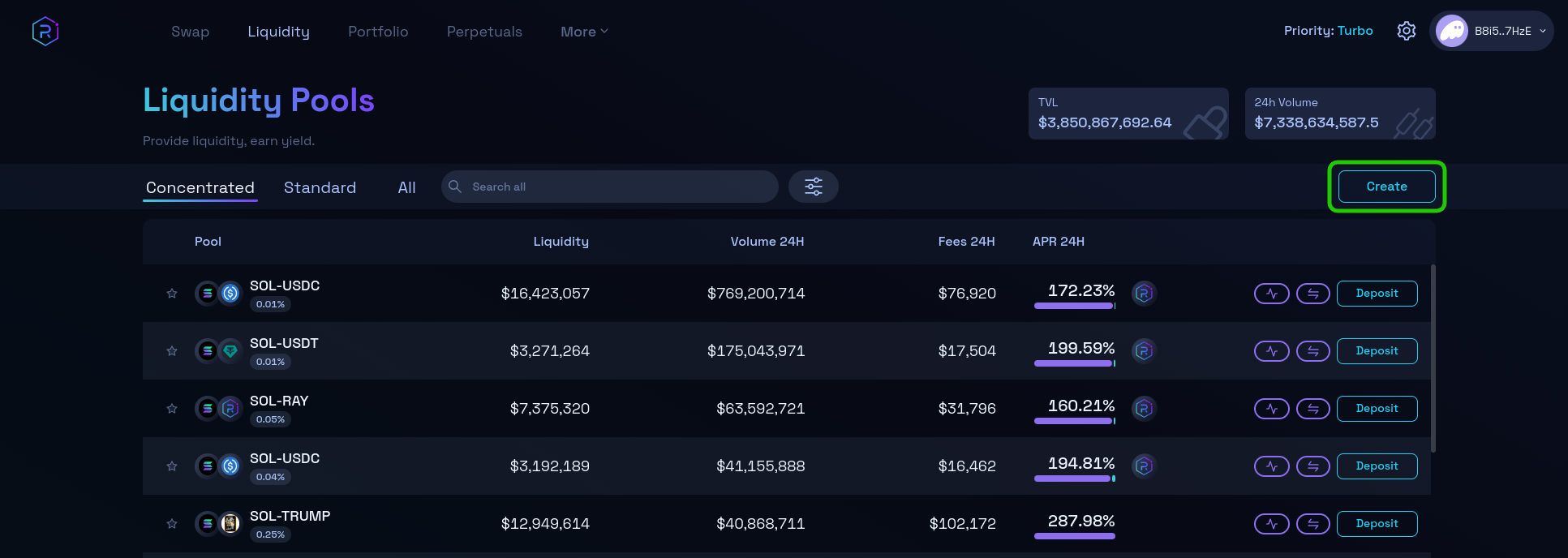

- Navigate to Raydium's liquidity page.

- Locate and click on the "Create" button in the top right corner.

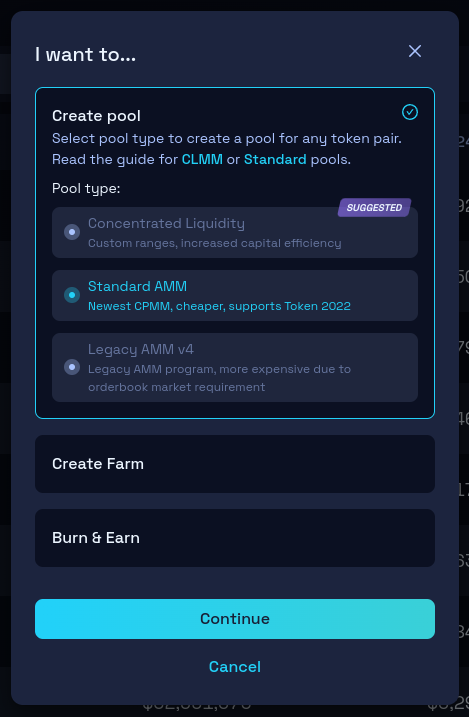

- In the modal window, choose the preferred pool type, such as "Standard AMM" and click "Continue".

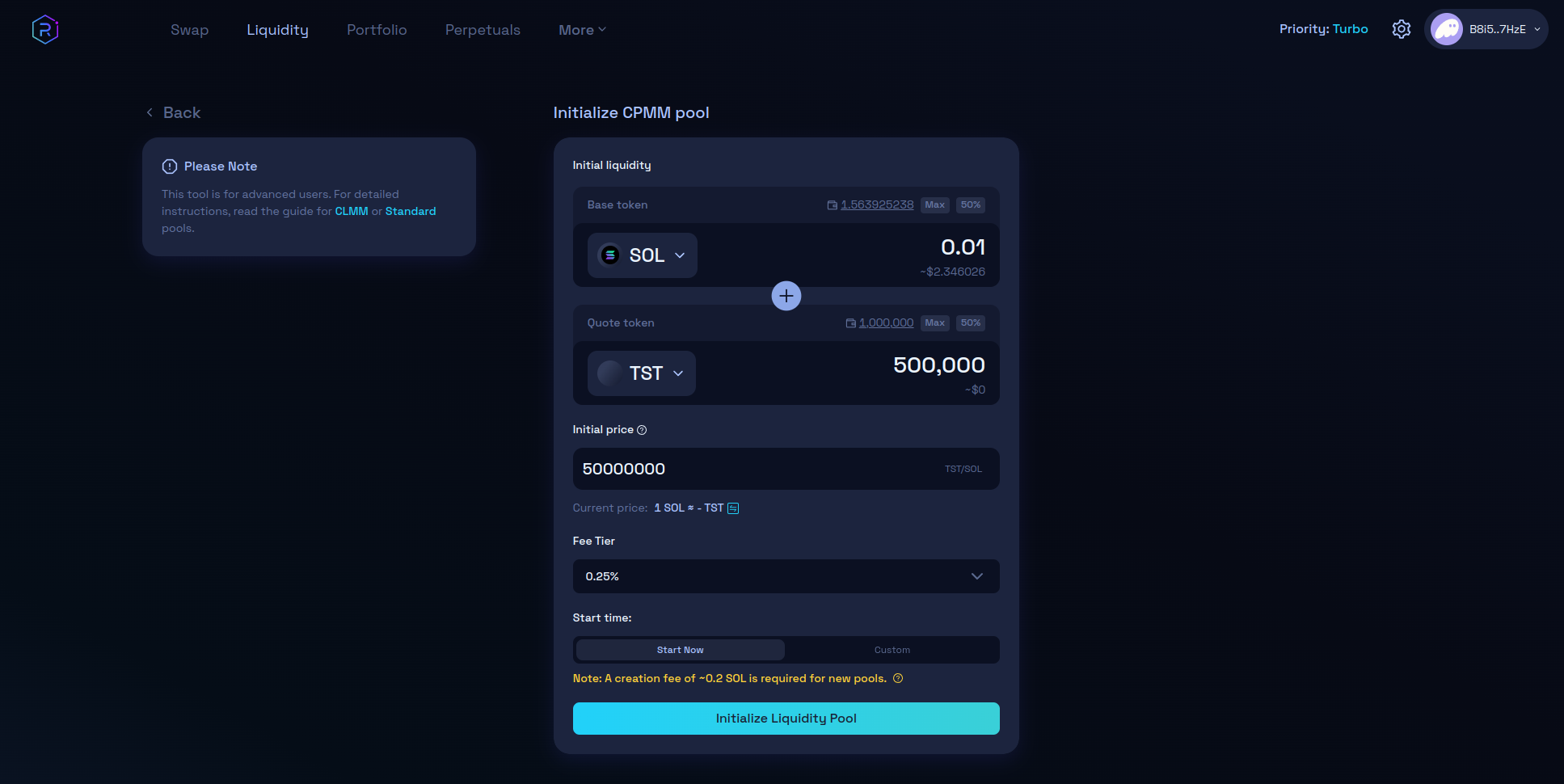

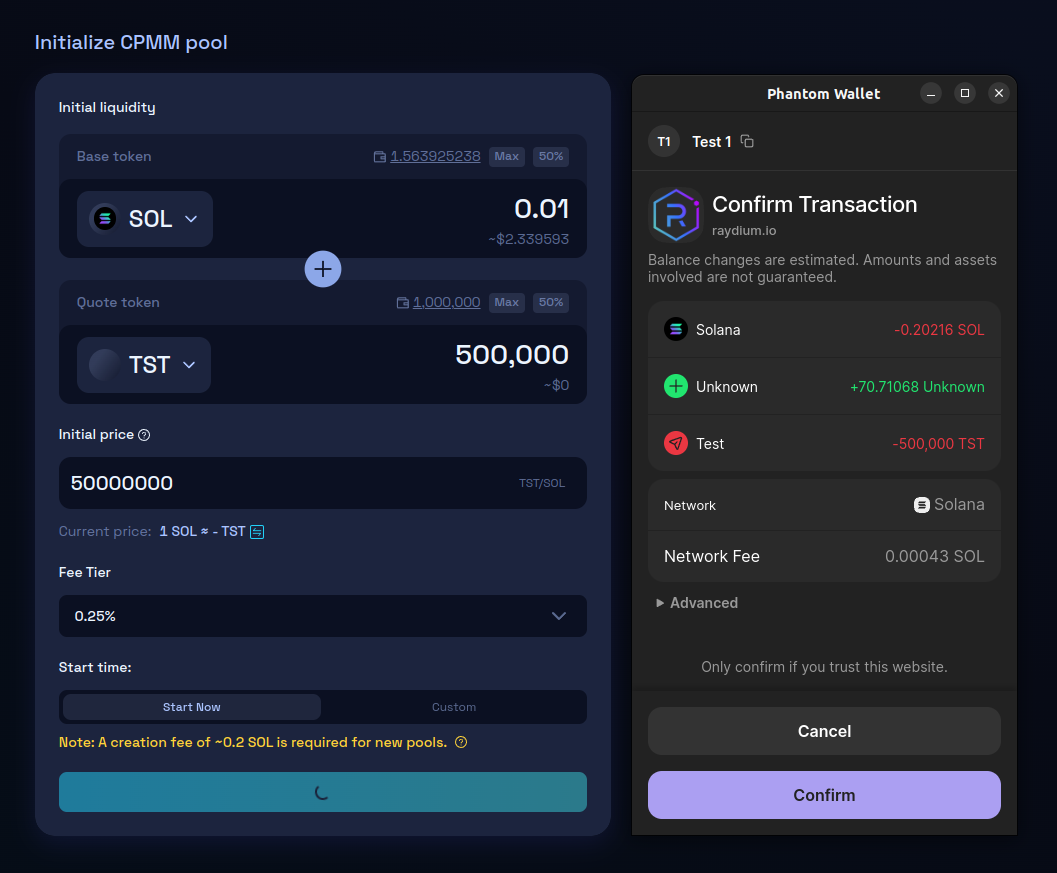

On the next page, in the liquidity pool interface, configure your pool parameters:

- Enter the amounts you wish to deposit for both: your token and collateral (e.g. SOL).

- Review the automatically calculated initial price.

- Select the fee level of the liquidity pool (recommended rates are: 0.25% or 1%).

- Optionally set the custom start time of the liquidity pool or start it immediately after adding liquidity. This option is similar to the EnableTrading feature of the ERC-20 tokens, but in this case on Solana it is provided directly by Raydium.

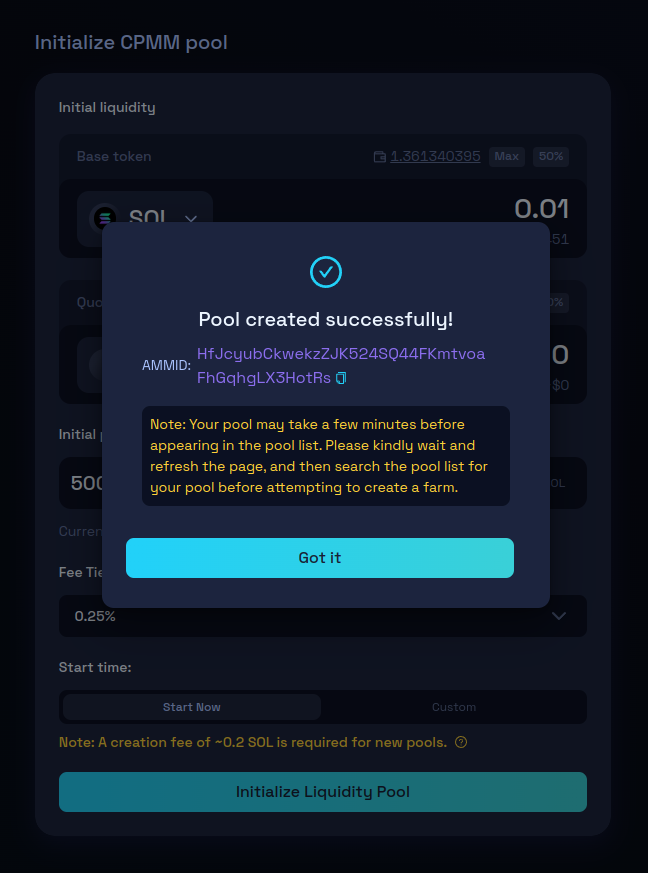

The last thing to do is to initialize your liquidity pool with the values provided. Take your time to carefully review all the parameters, make sure your wallet has sufficient funds, and proceed to confirm the transaction.

All done! Your token is now ready to be traded on Solana.

Security and Launch Management

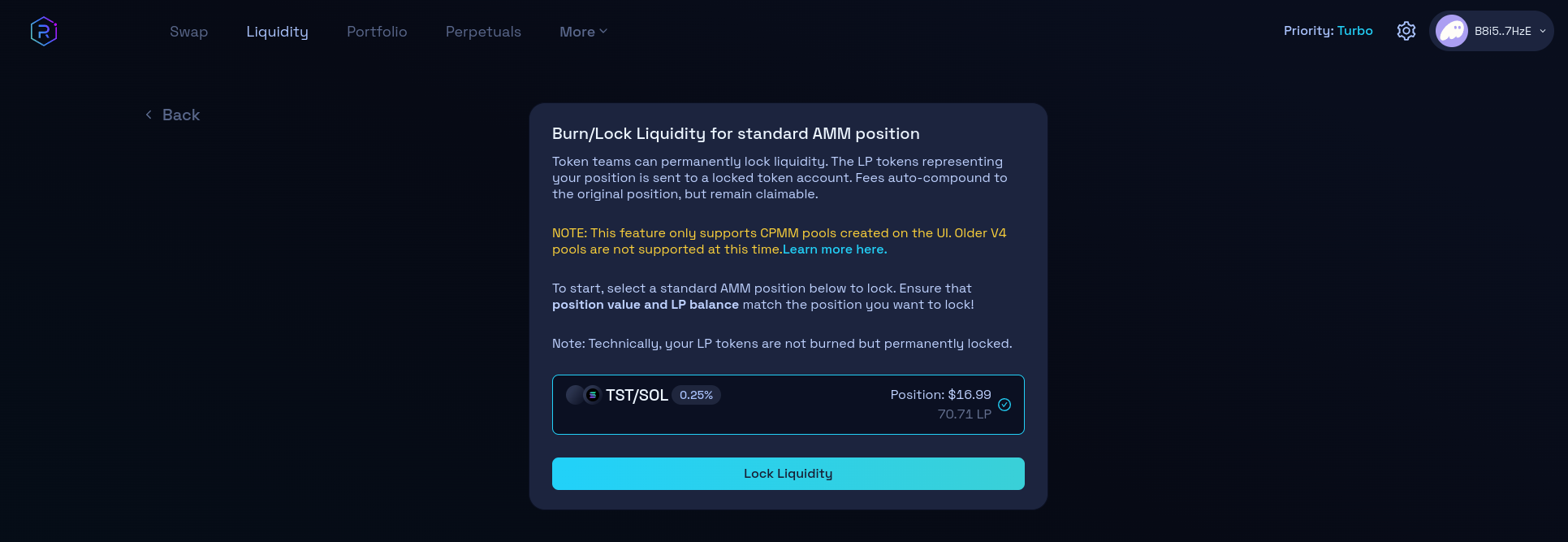

Protecting your liquidity pool is critical to building trust with your community. After adding initial liquidity, one of your first priorities should be to secure the LP tokens you receive. You have two main options for handling these tokens: burning or locking.

Burning LP Tokens via Raydium

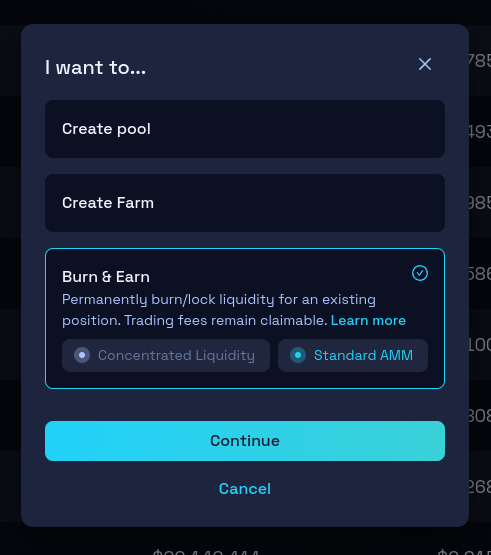

Burning your LP tokens represents the highest level of commitment to your project. By burning your liquidity on Raydium, you make it permanently inaccessible by locking it forever, while still earning trading fees on your liquidity pools. To do this, go to the Raydium liquidity panel, but this time click on "Burn & Earn" instead of "Create Pool".

This approach:

- Provides the strongest security guarantee for investors

- Demonstrates long-term commitment and confidence in the project

- Allows for the accumulation of trading fees from your pool

Locking LP Tokens

Alternatively, you can lock your LP tokens using trusted third-party services for a recommended minimum of 6 months. This approach provides:

- Flexibility for future liquidity management

- Time-locked security that can be verified on-chain

- Ability to adjust strategies as your project evolves

When choosing between burning and locking, consider the long-term needs of your project. While burning provides the strongest security signal, locking may be more appropriate if you anticipate needing to adjust your liquidity strategy in the future.

Post-Launch Monitoring

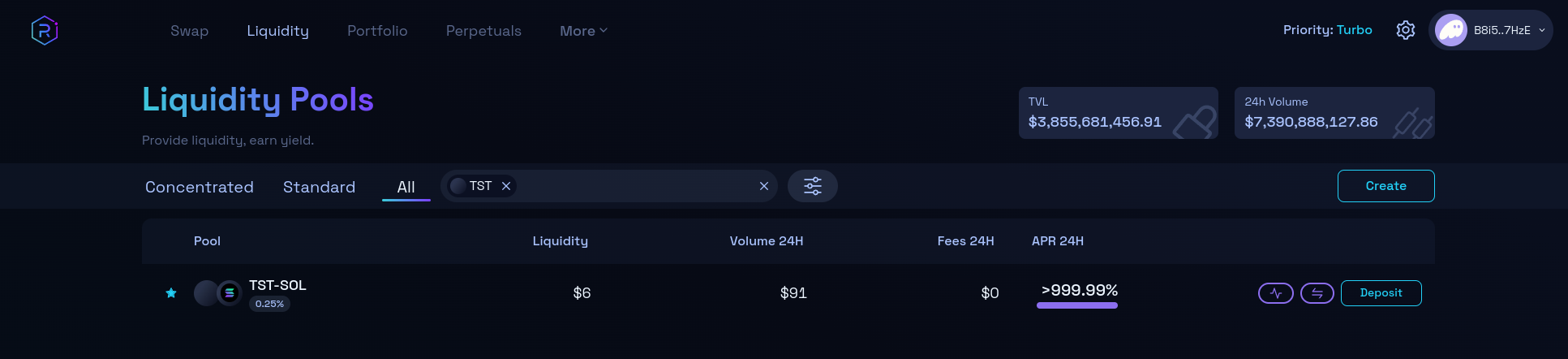

After launching your pool, you can easily track the performance of your pool through the Raydium's interface, which displays your active liquidity positions:

- Monitor trading volumes and fees

- Monitor price movements

- Analyze liquidity utilization (for concentrated liquidity pools)

You can also easily add more liquidity whenever needed or remove the portion that is not locked or burned.

Conclusion

Successfully launching a token on Raydium is a very straightforward process, similar to adding liquidity to EVM chains such as Ethereum or Base. The Standard AMM pools provide a more efficient and cost-effective path for token creators while maintaining robust trading functionality.

By following this guide and adapting these strategies to your specific project needs, you'll be well positioned for a successful token launch on Raydium. Remember that adding initial liquidity is just the beginning - maintaining a healthy liquidity pool and active community engagement are key to long-term success.

For more support with 20lab's token creation and liquidity pools, join our Telegram channel. Our team is here to help you succeed.