Quick Overview: QuickSwap for Token Launches

For token creators, choosing the right decentralized exchange is crucial for success in the competitive DeFi landscape. QuickSwap, Polygon's premier DEX, has established itself as a leading platform for token launches on Polygon, offering fast transactions, minimal fees, and a trusted Automated Market Maker (AMM) model. With billions in trading volume and seamless integration with major analytics platforms like DexTools and DexScreener, QuickSwap ensures your token gains immediate market visibility and liquidity.

Why Choose QuickSwap for Token Launch?

Cost-Effective Operations

Operating on Polygon, QuickSwap offers significantly lower transaction costs compared to Ethereum-based DEXes. This cost advantage allows projects to manage their liquidity more actively and enables traders to participate with lower capital requirements, making it an ideal choice for launching tokens on a budget.

Proven Reliability

QuickSwap's battle-tested smart contracts and straightforward mechanics make it a reliable choice for projects prioritizing stability and security. The protocol has maintained consistent operation since launch, processing massive trading volumes while maintaining high uptime - key factors for a successful token launch on Polygon.

Universal Compatibility

QuickSwap V2 pools support virtually any token implementation, including complex tokenomics with taxes or custom transfer logic. This flexibility is particularly valuable for projects with innovative token mechanics, ensuring a smooth token launch process.

QuickSwap V2 vs. V3

When launching your token on QuickSwap, you'll need to choose between V2 and V3 pools. Here's what you need to know:

QuickSwap V2

- Traditional pool design with uniform liquidity distribution

- Simple setup and management - ideal for new token launches

- Full support for tokens with tax mechanisms or custom logic such as liquidity tax or dividends

- Standard 0.3% trading fee

- Best choice for initial launches due to proven stability

QuickSwap V3

- Concentrated liquidity for higher capital efficiency

- Multiple fee tiers (0.01%, 0.05%, 0.3%, 1%)

- Requires active position management

- Better suited for established tokens with stable price ranges

- Limited support for tokens with complex mechanics

For most new token launches, V2 is recommended due to its simplicity and universal compatibility. V3's advanced features are typically more valuable for existing projects that can benefit from active liquidity management.

Step-by-Step Liquidity Addition Guide

Before proceeding to QuickSwap, ensure you have:

- The full address of your token contract.

- Connected to the Polygon network.

- Sufficient amount of your token in your wallet for the liquidity pool.

- POL tokens for liquidity and transaction fees.

Adding Liquidity Through 20lab

The 20lab platform offers a streamlined approach for adding liquidity to QuickSwap. This integration simplifies the process significantly and reduces the chance of errors during setup, making it an excellent choice for first-time token creators.

If you've created your ERC-20 token using 20lab's token generator and selected QuickSwap as your default exchange, follow these steps:

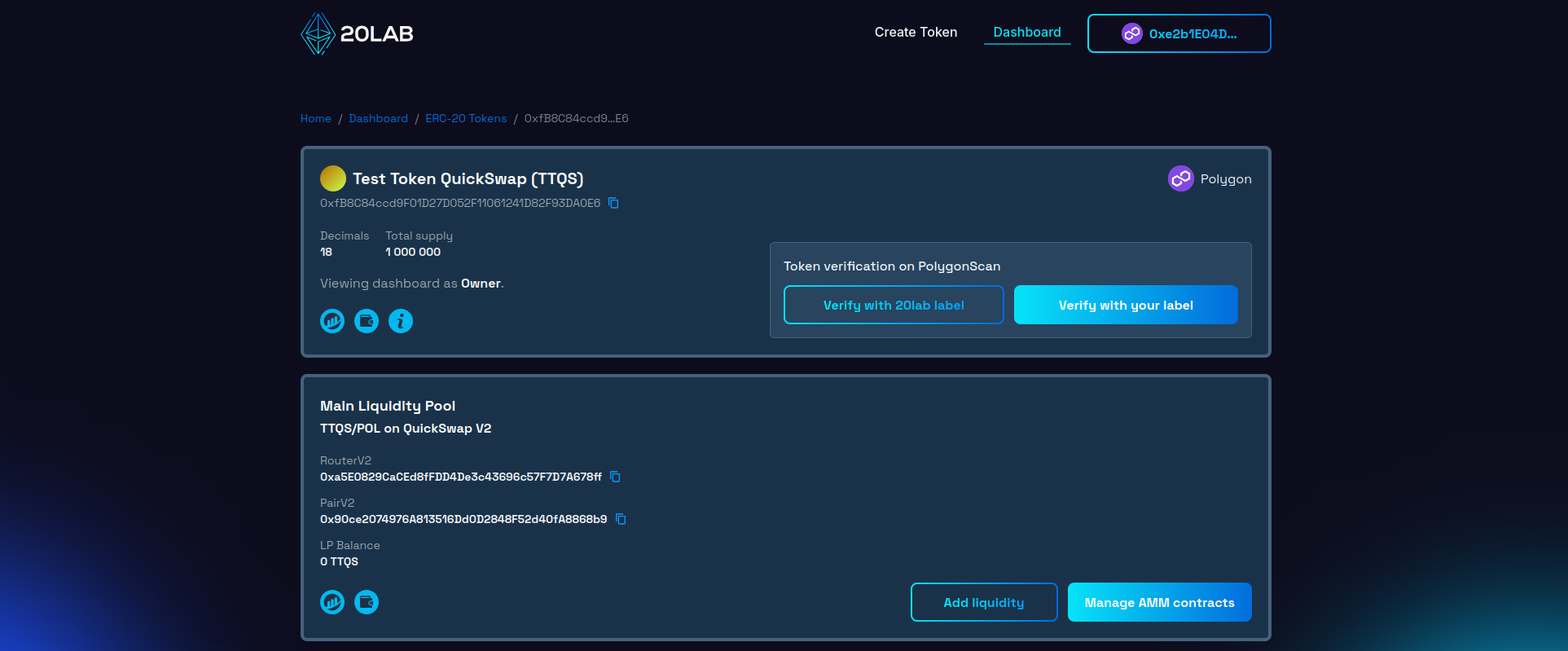

- Navigate to your 20lab owner dashboard.

- Find your token in the created tokens list.

- Locate the "Main Liquidity Pool" section showing "QuickSwap".

- Click "Add liquidity" to be redirected to the correct QuickSwap pool page.

Manual Liquidity Addition

For projects that prefer more direct control, without default exchange chosen, or aren't using 20lab, the manual liquidity addition process provides complete flexibility in setting up your pool. While this approach requires more attention to detail, it gives you full control over every aspect of your liquidity pool setup.

To find QuickSwap liquidity page manually, follow these steps:

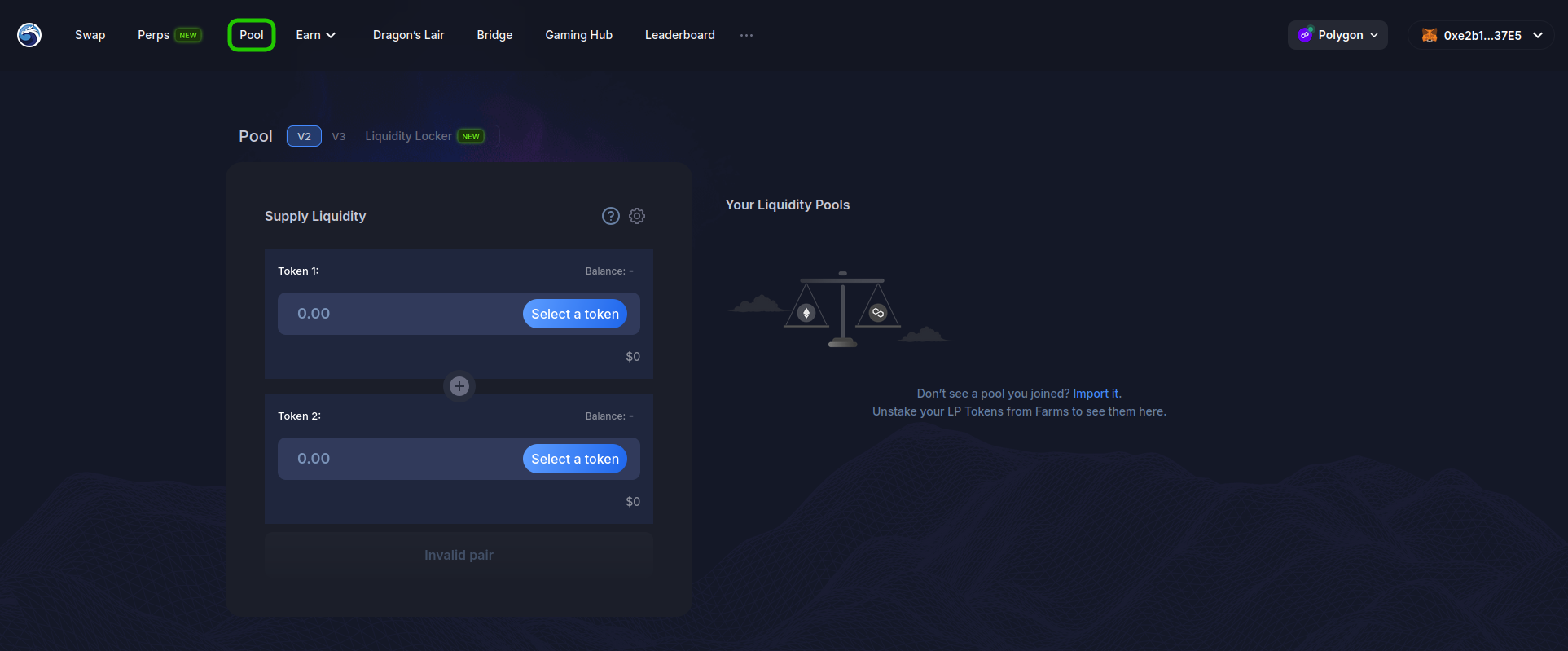

- Visit QuickSwap's official interface.

- Connect your Web3 wallet and ensure you're on the Polygon network.

- Navigate to the "Pool" section.

- Choose between V2 or V3 pool type for your liquidity.

Pool Creation and Security

The pool creation process marks a critical moment in your token's journey. This step requires careful consideration of various parameters that will affect your token's trading dynamics.

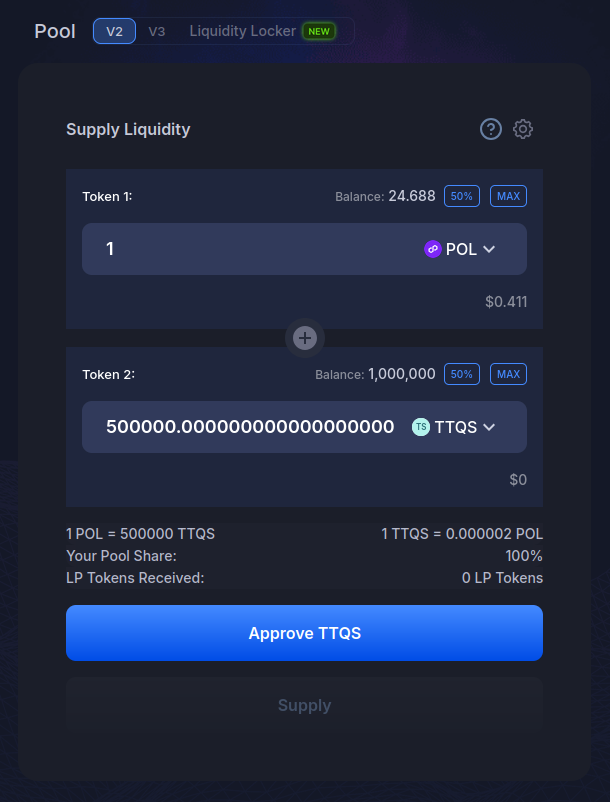

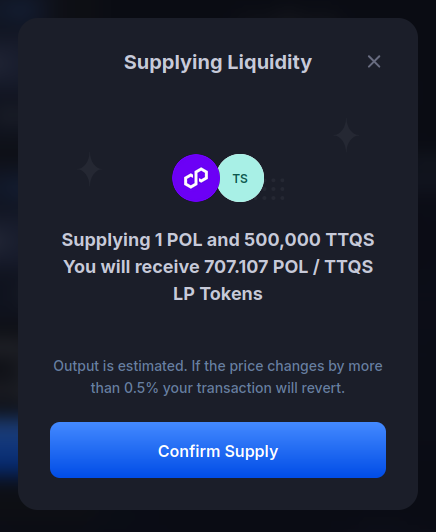

In order to finish adding liquidity on V2, you'll need to:

- Select the base token/collateral (POL, USDC, etc.).

- Enter your token's contract address in the second field.

- Choose how much of collateral and your tokens to put into liquidity pool.

- Approve your tokens for QuickSwap's router contract.

- Confirm the liquidity addition transaction.

- Wait for both transactions to be confirmed on-chain.

Locking Liquidity on QuickSwap

After adding liquidity, securing your LP tokens is crucial for building trust with your community. To accomplish this, you always have 2 options: locking or burning.

The decision between burning and locking your LP tokens carries significant implications for your project's future. While burning provides the highest level of security assurance to investors, it also removes any flexibility in adjusting your liquidity strategy. Locking, on the other hand, offers a balance between security and future adaptability.

LP Token Burning

For projects seeking to demonstrate the highest level of commitment to their community, LP token burning provides an irreversible solution. This process involves sending your LP tokens to a verifiable dead address (0x0000...dead or 0x0000...0000). While burning offers unmatched security guarantees that resonate strongly with investors, it's important to understand that this action cannot be undone. Once burned, these LP tokens are permanently removed from circulation, meaning you won't be able to remove the associated portion of liquidity in the future.

Before proceeding with burning, carefully consider your project's long-term needs. This permanent commitment should align with your overall tokenomics and business strategy.

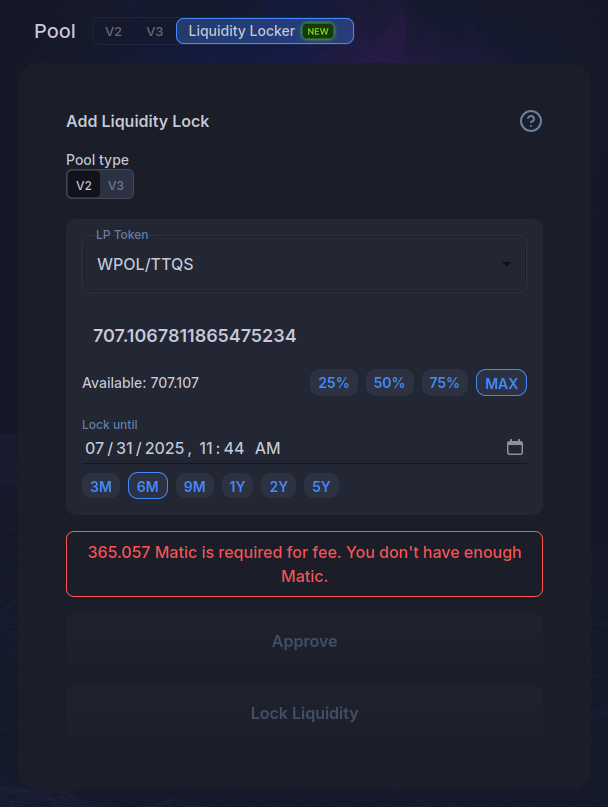

Native Locker

Some time ago, QuickSwap introduced its native token locker, which provides a secure and transparent way to lock your LP tokens directly through the platform. This integrated solution offers convenience while maintaining high security standards.

The locking process is now very simple:

- Navigate to the "Liquidity Locker" section next to the pool type selection.

- Select the correct pool type.

- Select your LP tokens from the dropdown.

- Set the lock duration (minimum recommended: 6 months).

- Enter the amount of LP tokens to lock.

- Confirm the transaction and your LP lock will be created.

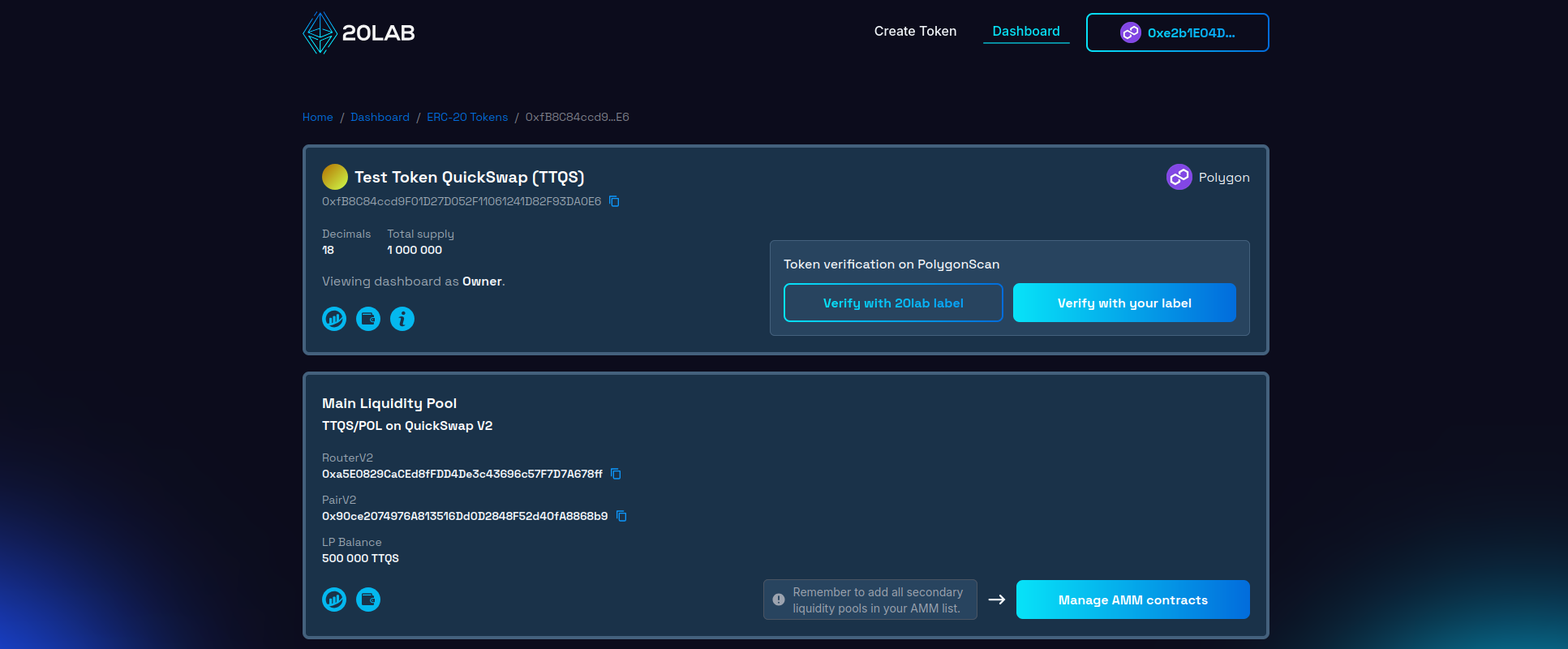

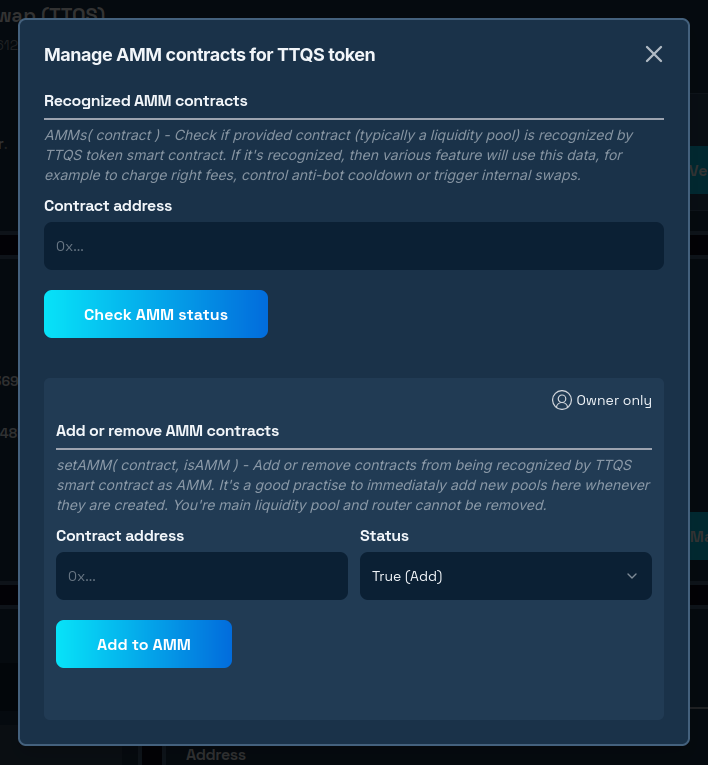

Managing Liquidity Through 20lab Dashboard

The 20lab dashboard serves as a central command center for managing your token's liquidity and trading parameters on QuickSwap. This integrated solution streamlines the often complex process of liquidity management, providing project owners with powerful tools and real-time insights.

For tokens created using 20lab's generator with QuickSwap integration, the dashboard provides many features:

- Real-time monitoring of LP token balance

- Options to add secondary liquidity pools

- Management of trading restrictions and protection parameters

- Intuitive controls for advanced features like EnableTrading function

When it comes to protecting your liquidity pools, 20lab offers several advanced security features. You can implement max transaction limits to prevent large swings in liquidity, and set up anti-bot protections during the crucial launch phase. For added security, you can enable blacklist functionality to protect against known malicious addresses, and implement various taxes separately on buys, sells and other transaction types.

Conclusion

Launching your ERC-20 token on QuickSwap combines the power of Polygon’s scalable infrastructure with a battle-tested DEX platform designed for success. With its low transaction costs, proven reliability, and universal compatibility, QuickSwap ensures your token gains immediate visibility and liquidity. Whether you choose QuickSwap V2 for its simplicity and full support for complex tokenomics or V3 for advanced liquidity management, the platform provides the tools and flexibility needed to thrive in the competitive DeFi landscape.

From adding liquidity through 20lab’s streamlined process to manually setting up pools for complete control, QuickSwap makes it easy to launch and manage your token. Features like LP token locking and burning further enhance security and trust, while tools like the 20lab dashboard offer real-time insights and advanced protections to safeguard your project. By following this guide, you’ll be well-positioned to navigate the token launch process with confidence.

Ready to take the next step? Join our Telegram channel if you have any questions or need support. With QuickSwap and 20lab, your token launch journey is in good hands - start building today!